What is Health Insurance?

Health Insurance, also known as Mediclaim in India, is a form of insurance which covers the expenses incurred on medical treatment and hospitalisation. It covers the policyholder against any financial constraints arising from medical emergencies. In case of sudden hospitalisation, illness or accident, health insurance takes care of the expenses on medicines, oxygen, ambulance, blood, hospital room, various medical tests and almost all other costs involved. By paying a small premium every year, you can ensure that any big medical expenses, if incurred, will not burn a hole in your pocket. The plan can be taken for an individual or for your family as a Family Floater Health Insurance Plan.

Major Benefits in a Health Insurance Policy

Cashless facility

Each health insurance company ties up with a large number of hospitals to provide cashless health insurance facility. If you are admitted to any of the network hospitals, you would not have to pay the expenses from your pocket. In case the hospital is not part of the network, you will have to pay the hospital and the insurance company will reimburse the costs to you later.

Pre-hospitalisation expenses

In case you have incurred treatment costs for the ailment for which you later get admitted to a hospital, the insurance company will bear those costs also. Usually the payout is for costs incurred between 30 to 60 days before hospitalisation.

Hospitalisation Expenses

Costs incurred if a policyholder is admitted to the hospital for more than 24 hours are covered by the health insurance plan.

Post-hospitalisation expenses

Even after you are discharged from the hospital, you will incur costs during the recovery period. Most mediclaim policies will cover the expenses incurred 60 to 90 days after hospitalisation.

Day Care Procedure Expenses

Due to advancement in technology some of the treatments no more require a 24 hours of hospitalisation. Your health insurance policy will cover the costs incurred for these treatments also.

Ambulance Charges

In most cases the ambulance charges are taken up by the policy and the policy holder usually doesn't have to bear the burden of the same.

Cover for Pre-existing Diseases

Health insurance policies have a facility of covering pre-existing diseases after 3 or 4 years of continuously renewing the policy, i.e. if someone has diabetes, then after completion of 3 or 4 years of continuous renewal with the same insurer (depending on the plan offered and his age), any hospitalisation due to diabetes will also be covered..

Tax Benefits

The premiums paid for a Health Insurance Policy are exempted for Under Section 80D of the Income Tax Act. Income tax benefit is provided to the customer for the premium amount till a maximum of Rs. 15,000 for regular and Rs. 20,000 for senior citizen respectively.

કાચ જેવા ફોનનો વિડીયો

No-Claim Bonus

If there has been no claim in the previous year, a benefit is passed on to the policyholder, either by reducing the premium or by increasing the sum assured by a certain percentage of the existing premium.

Health Check-Up

Some health insurance policies have a facility of free health check-up for the well being of the individual if there is no claim made for certain number of years.

Organ Donor Expenses

The medical expenses incurred in harvesting the organ for a transplant is paid by the policy.

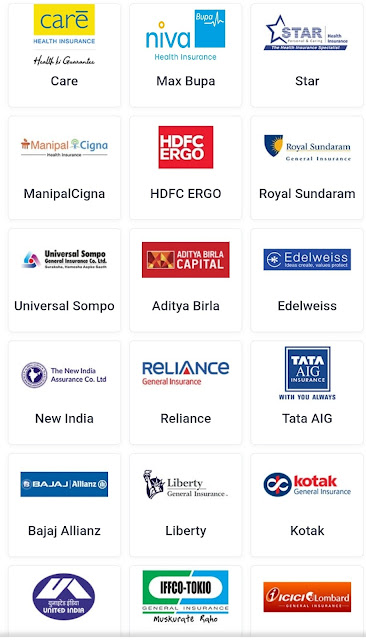

Popular Health Insurance Companies

1. Why should you purchase a health insurance plan ?

A health insurance plan is a protective measure that prevents you from using your savings in a medical emergency. When faced with a medical emergency, you will have to use your funds from your savings to cover the expenses, unless you are insured. However, with a health insurance policy, you can claim coverage up to the sum insured.

2. Do different companies offer different insurance policies?

A: Yes, they do. Some of the policies are designed to provide individual coverage, while others are family health insurance policies. Similarly, depending upon the premium paid, the health condition of the person or persons being insured, the policy will differ. Thus, depending on the type of policy you are purchasing and the insurance company you are purchasing from, you will be provided a particular healthcare policy.

3. What are the parameters to purchase a health insurance?

A: When you purchase a health insurance policy, you should check the coverage provides, i.e., whether the insurance policy covers medical bills, hospitalization expenses, ambulance charges, medical expenses due to severe illnesses, and domiciliary hospitalization charges. Similarly, the insurance company you are purchasing the policy should be associated with the leading hospitals in your area. Other than that, it should also have a network of hospitals across the country. This will assure you that the policy you purchase is acceptable anywhere in India.

4. Should claims be a factor while comparing health policies? A: Yes, you should check the claims records of the insurance company when purchasing a health insurance policy. For example, Star Health Insurance has incurred a claim ratio of 63%. Apollo Munich Health Insurance, a joint venture of HDFC Limited and ERGO International AG, has posted a claim ratio of 62%. Both of these are higher than Religare Enterprise Limited, which has incurred a claim ratio of 55%. Hence, if you are thinking of purchasing health insurance from a company with a higher ratio of claim settlement, you can opt for Star Health Insurance or Apollo Munich Health Insurance.

5. Why should you purchase health insurance from Oriental Insurance Company Limited? A: Oriental Insurance Company Limited has numerous insurance-related products. The company has been providing clients with numerous healthcare policies for many years. Additionally, people above the age of sixty do not have to undergo a rigorous medical check-up to purchase an insurance policy. The company also has a network with more than 4300 hospitals across the country. It has incurred a claim ratio of 108%.

Cashless claims in 20 mins: With our 24x7 quick support, cashless claims can be settled in 20 mins and reimbursement claims in 4 hrs! ✌️

10,000+ Cashless Network Hospitals: We have the largest network of cashless hospitals spread across India, so we’ll be there for you wherever you are in the country.🏨

97% Claim Settlement Ratio: With 12 lakh+ happy customers and a high claim settlement ratio. Our numbers speak for us. 😊

Fully Transparent: From getting the quote, buying the policy to getting the claims settled, you can track everything from the app at any time. No hidden clauses, terms and condition. 🙌

No paperwork, completely digital: No long proposal forms & lengthy inspections. With the click of a few buttons, we will instantly send your policy to you on Whatsapp! Access health card and raise the claims from the app itself! 🤩

Monthly EMIs starting from ₹240: Safeguard yourself and your family at really affordable prices! 😄

Subscribing to a new health insurance plan, calculating the premium, making payment for an EMI or a renewal, submitting a claim, locating a network hospital, or tracking the claim status, you can complete all the tasks within a matter of minutes with this all-in-one Health Insurance App.

અહીંથી પ્રીમિયમ કેલ્ક્યુલેટર પર જાણો તમારું કેટલું પ્રીમિયમ આવશે

અહીંથી જુઓ વિવિધ કંપનીઓના હેલ્થ ઇન્સ્યોરન્સ પ્લાન

6. What are the benefits of purchasing a healthcare policy from National Insurance Company Limited? A: National Insurance Company Limited has been providing various types of insurance policies to its customers for almost one hundred years. If you are thinking of buying a health insurance policy from a reputable firm, you should buy a health insurance policy from National Insurance Company Limited. The company also offers free health check-ups and has a claim ratio of 109.94%.

6. What are the benefits of purchasing a healthcare policy from National Insurance Company Limited? A: National Insurance Company Limited has been providing various types of insurance policies to its customers for almost one hundred years. If you are thinking of buying a health insurance policy from a reputable firm, you should buy a health insurance policy from National Insurance Company Limited. The company also offers free health check-ups and has a claim ratio of 109.94%.

7. What are the cashless benefits? A: Some insurance companies may allow the insured to enjoy a cashless hospital admission. Here the insurance company will settle the cost of hospitalization directly, and you will not have to pay any upfront. As a policyholder, you will not have to make any payment during hospitalization.

8. Is there a government insurance company?

A:Yes, New India Assurance Company is a government-owned multinational general insurance company. The first offer was made by a company called Mediclaim Policy. The company has a strong presence in India but in 28 other countries of the world. The company has noted the claim ratio.

.gif)

No comments:

Post a Comment